- Dermatology

- Surgical Dermatology

- Aesthetics

- Wellness

Patient Resources

Insurance & Self-Pay Options

At Integrative Dermatology, we understand that finances shouldn’t stand in the way of your skincare goals. That’s why we offer a variety of flexible payment options to fit your individual needs.

Insurance billing and flexible payment options

At Integrative Dermatology, we understand that finances shouldn’t stand in the way of your skincare goals. That’s why we offer a variety of flexible payment options to fit your individual needs:

Medical billing & claim processing is a complex subject. It may cause frustration and financial hardships when not considered before seeking care. When you add in variable self pay pricing and clinic policies for cosmetic procedures, it can feel overwhelming. We will break down everything for you on this page.

Note: we are not contracted with Kaiser or State Insurance.

Integrative Dermatology Payment Options

With a blend of medical expertise and advanced skincare technology, we offer tailored treatments that address both facial and body concerns.

Bill

Insurance

Patient Choice

-

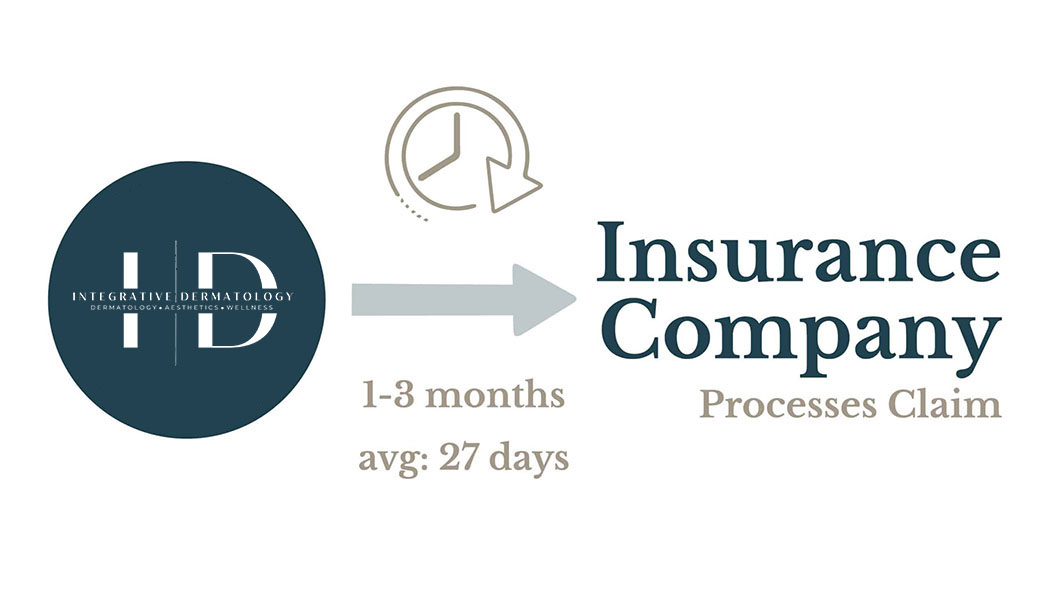

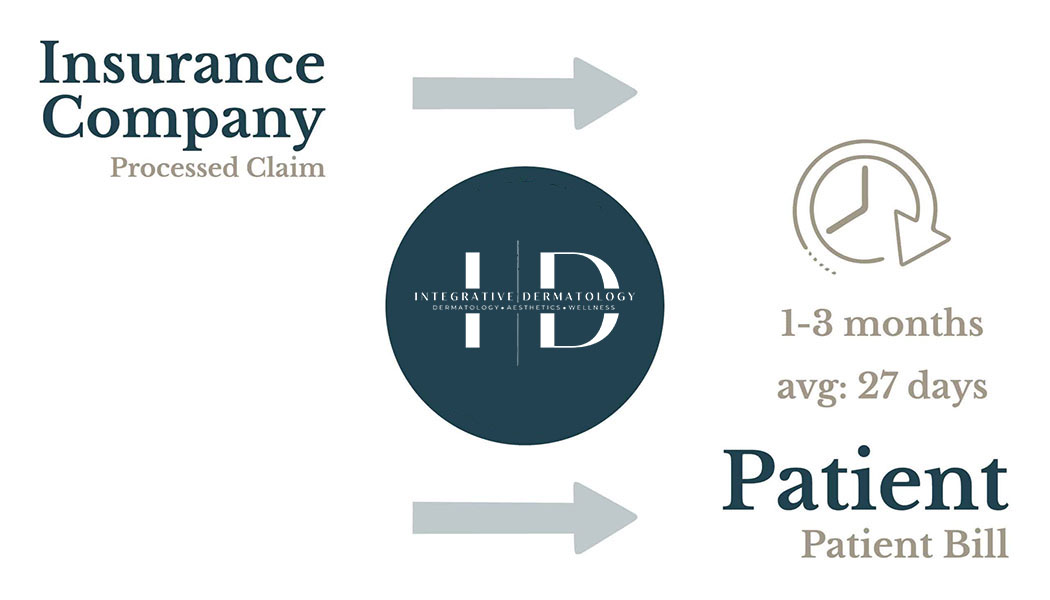

Pay copay at check-in & bill 1-3 months after visit

-

Pros

-

Might be less or even $0 out of pocket

-

Out of pocket costs go towards deductible

-

Cons

-

Cannot change after claim has been submitted

-

Might be more expensive

-

Patient bills will come months after care

-

Important

-

Pathology and Lab bills are billed separately (not by Integrative Dermatology)

Self pay

Patient Choice

-

Pay at check-out

-

Pros

-

Designed for uninsured

-

Might be less out of pocket

-

Transparent pricing – no hidden costs or suprise bills

-

Cons

-

Out of pocket costs DON’T go towards deductible

-

Labs must be obtained elsewhere

-

Important

-

Pathology and Lab bills are billed separately (not by Integrative Dermatology)

Cosmetic

Self pay

Cosmetic

-

Pay at check-out

-

Pros

-

Transparent Pricing

-

Ability to seek reimbursement

-

Cons

-

Cannot be billed through insurance

-

Important

-

All cosmetic procedures are self-pay at the time of service.

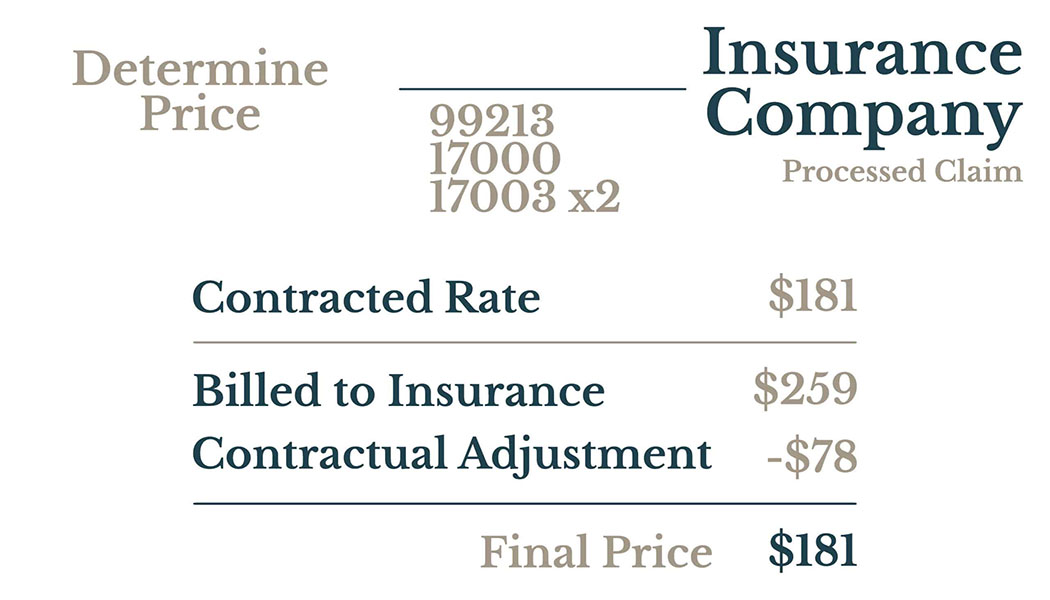

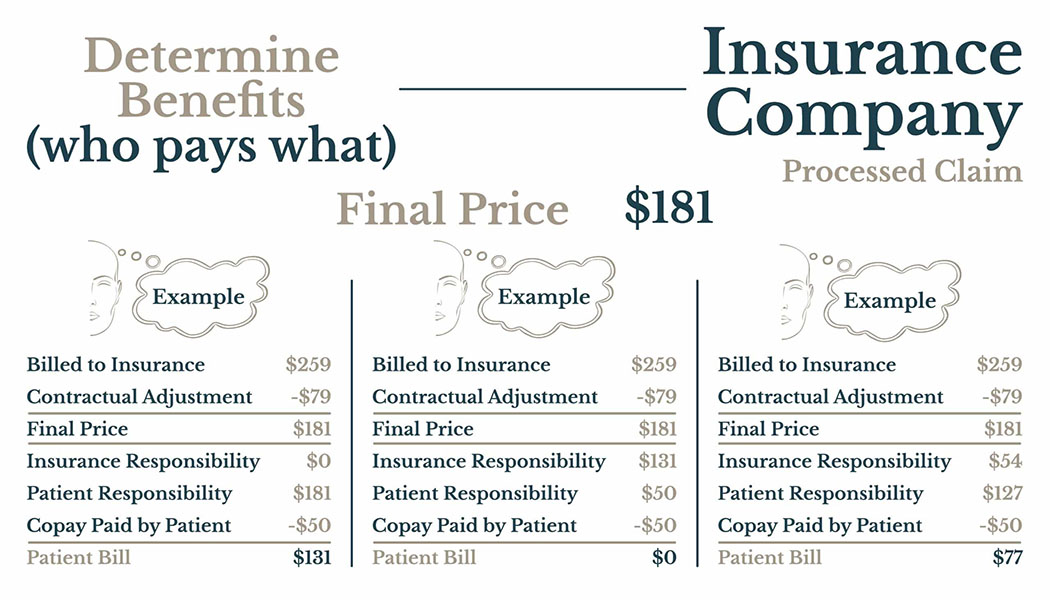

Insurance Billing: How it Works

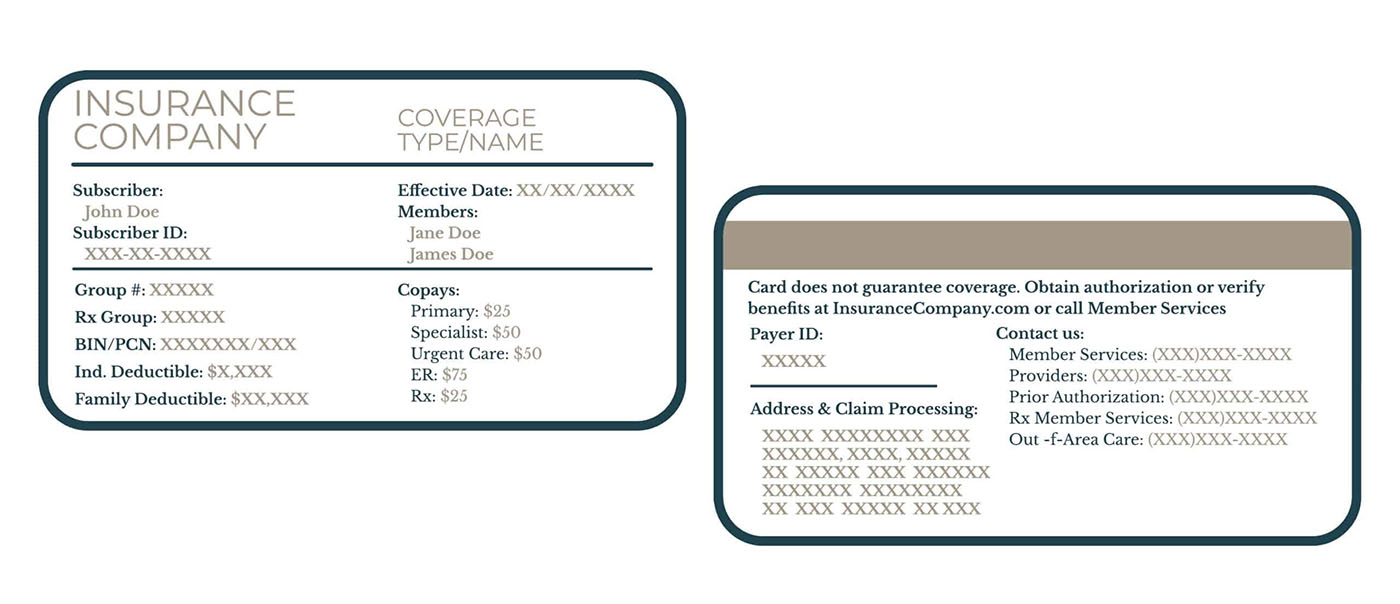

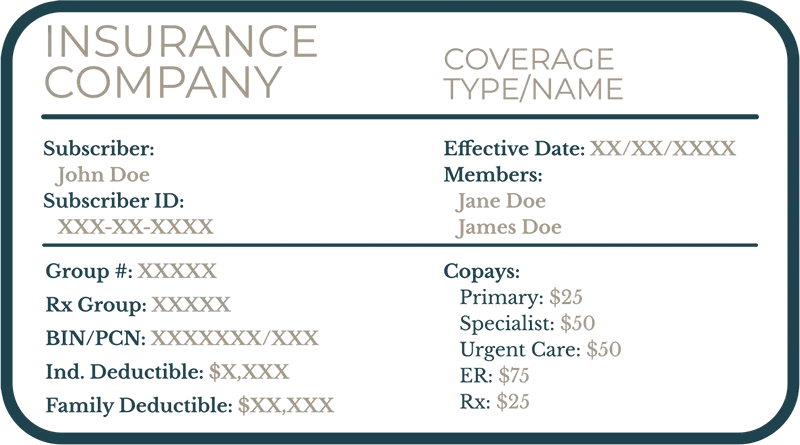

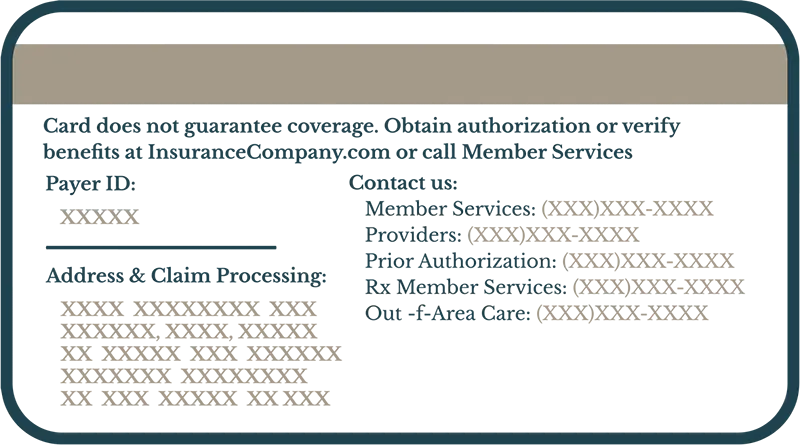

Insurance Card

How to Read Insurance Card

Subscriber

This is the name of the primary insurance holder. It’s often the person whose name the insurance policy is under (e.g., the employee, parent, or spouse).

Subscriber ID

This is a unique identification number assigned to the primary insurance holder. It’s like your personal account number with the insurance company and is essential for claims processing.

Effective Date

This date indicates when your insurance coverage began. Services received before this date may not be covered.

Members

This section lists all individuals covered under the insurance plan (e.g., spouse, children). Sometimes, instead of listing all members, it may say “See member ID card” or similar.

Group #

This number identifies the employer or group that sponsors the insurance plan (if applicable). It connects you to a specific plan offered through a company or organization.

RX Group

If your plan includes prescription drug coverage, this number may be specific to that benefit and is used when filling prescriptions.

Individual Deductible

This is the amount you must pay out-of-pocket for covered healthcare services before your insurance starts to pay a significant portion. This applies to each individual covered under the plan.

Family Deductible

Similar to the individual deductible, but this is the total amount the entire family must pay for covered healthcare services before the insurance starts to pay a significant portion. Often, the family deductible is a multiple of the individual deductible.

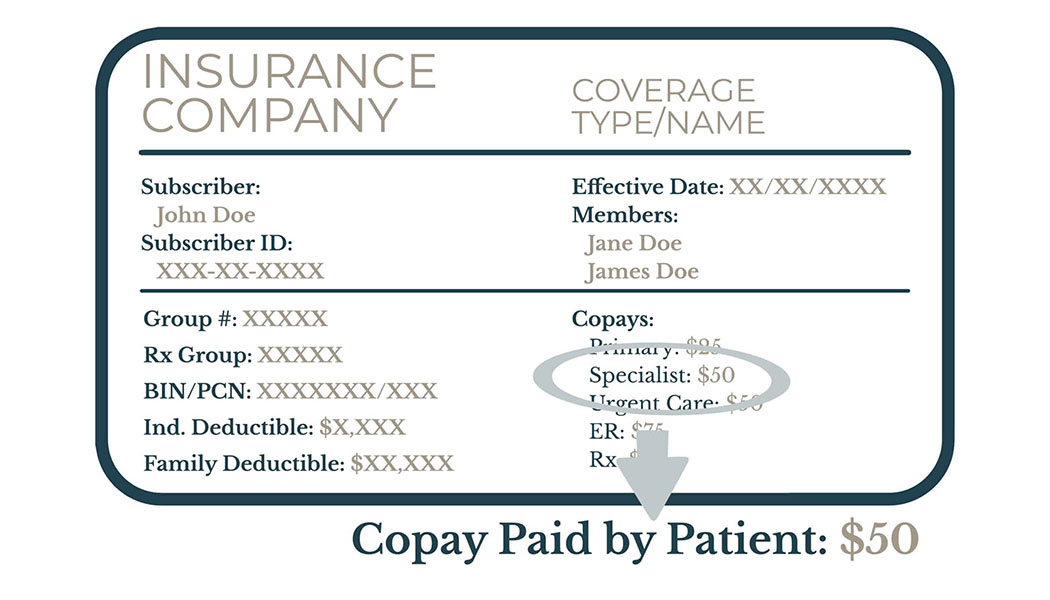

Copays

These are fixed amounts you pay for specific healthcare services, such as doctor’s visits or prescriptions. They are typically paid at the time of service. Your card may list different copay amounts for different types of services (e.g., primary care physician, specialist, emergency room).

Payer ID

This is a unique identification number assigned to each insurance company or payer. It’s used electronically to route claims to the correct insurance company for processing.

Contact Service Numbers

Your insurance card should list phone numbers for various services, such as:

- Customer/Member Service: For general questions about your coverage, claims, or benefits.

- Claims: To inquire about the status of a claim.

- Pre-authorization: To obtain approval for certain procedures or treatments.

- Nurse Line: For health advice or to speak with a registered nurse.

BIN/PCN:

These are numbers used by pharmacies to process prescription claims.

- BIN (Bank Identification Number): Directs the claim to the correct insurance company.

- PCN (Processor Control Number): Identifies the specific plan or group for prescription benefits.